220 Central Park South: The Skyscraper that Ended New York’s Billionaires' Row

- Youtube Views 1,739,314 VIDEO VIEWS

Video hosted by Fred Mills. This story was created in collaboration with The Real Deal building upon reporting from The inside story of 220 Central Park South, the world’s most profitable condo. This video is sponsored by and contains paid promotion for AMD.

NEW YORK CITY: home to America’s biggest buildings, its largest transit system and the highest concentration of billionaires anywhere in the world. Here, money runs everything.

Down on the ground, the city is bursting at the seams with a relentless entrepreneurialism – whether it's multimillion-dollar boardroom brawls, bidding wars on exclusive apartments or just hustling to pay the ever rising rent.

But high above it all lies a market that’s hidden in the clouds. One that doesn’t really adhere to the standard rules of real estate or engineering.

Nine-figure deals, pencil-thin towers, and cutthroat brokers: New York’s Billionaires' Row is construction at its most extreme.

These insane skyscrapers are what you get when you combine super-small plots of land, restrictive zoning laws, amazing engineering advancements, money and sheer willpower – they break almost every mould and now stand as marvels of modern design.

But even among this new forest of supertall luxury, there’s one tower that stands out from the rest and creates a genre all on its own. It’s not the most eye-catching skyscraper on the block, but the story behind it is unlike anything we’ve ever seen before.

220 Central Park South has it all – developer clashes, insane engineering, extreme wealth, ruthless power, foreign money, and backdoor deals.

This is how a little-known skyscraper quietly became the crown jewel of Billionaires' Row.

Above: 220 Central Park South sits on Billionaires' Row in New York City. Image courtesy of The Dronalist.

The Place To Be

The skyscraper made New York.

When it was developed, this ancient island was covered in greenery – and if it had stayed low-rise it probably wouldn’t have amounted to much. But these extraordinary towers have allows it to continuously increase its area and welcome millions of people and businesses.

Each shaped by the powerful geographic and economic context of their time, the city’s skyscrapers now stand as silent chapter markers in its ever-evolving story.

At the turn of the 20th century, things were no different. New York’s population was booming, and so was its development.

That ushered in a new era of construction: one that lured in wealthy residents with luxurious co-ops for sale. Think ornate facades, exclusive amenities and a cutthroat application process ruled by notoriously stuffy co-op boards.

And so began the carousel of New York’s ‘it’ building – a coveted status symbol marked by steel and stone.

One of the earliest stood at 834 Fifth Avenue on the Upper East Side. Completed in 1931 and home to Laurance Rockefeller. It was once described as the “most pedigreed building on the snobbiest street in the country’s most real estate-obsessed city.”

Also built in the 30s was 740 Park Avenue – once home to John D. Rockefeller Jr.

For nearly a century, these roads right alongside Central Park have been the most coveted corridor in New York City, then around the mid 2000s another building started turning heads.

Right across the park stood 15 Central Park West – a two-sectioned asymmetrical tower with a striking limestone facade.

Only this one was a condo, not a co-op. That meant buyers no longer needed a legacy name to get their application noticed. A massive bank account was enough to get you in the door.

15 Central Park West drew in CEOs, celebrities, tech executives – even the daughter of a Russian oligarch bought the penthouse for $88M. Then around the start of the 2010s something changed. We saw not just one building but an entire street of skyscrapers become the city’s new “place-to-be” – Billionaires' Row.

Above: The view of Billionaires' Row above Central Park.

Kicking off with One57 in 2014, and then 432 Park Avenue the following year, this series of supertall skyscrapers lined-up along the southern edge of Central Park.

That’s impressive given there are hardly any sites left in this congested corner of one of the world’s most congested cities.

With only small parcels of land available, developers found themselves under pressure to maximise floor area and park views in order to drive a return: a pressure they passed on down to their engineers.

The result was the rise of a whole new architectural style. Meet the super-slender skyscraper: an elegant, 21st century solution to some very 21st century constraints. Width-to-height ratios were pushed to the extreme, foundations went to a different league and super strong concrete cores were paired with stabilisation tricks like dampers and open floors that help manage intense wind loads.

This new breed of building is seriously thin. 111W57 – the world’s thinnest skyscraper – has a width-to-height ratio of 1:24. Compare that to One Madison or 520 Park Avenue – buildings already considered slender – and you get the picture.

Engineers had broken a frontier and a phenomenon emerged: the ability to buy newly built apartments, in a supertall skyscraper, with uninterrupted views of Central Park – and the world’s wealthiest people snapped them up.

Over the last couple of decades, wealth inequality, particularly in the US, has been widening. Today, the top 1 percent of Americans own a much bigger share of the total wealth than the middle 40 percent. And if you zoom out and take a look at the wider world, you’ll see that the richest 10 percent of people control a whopping 76 percent of the wealth.

Essentially, that means there’s now more money in the hands of fewer people. And many of those people are looking to secure and grow their wealth even more by investing what’s long-been one of their safest bets: luxury real estate.

The Exception

The new “Billionaires' Row” that emerged from all this is big, bold and architecturally impressive. It now dominates the world’s most famous skyline and has forever changed the shape of it.

But you won’t find the most technically challenging and financially successful building in the area among the acres of photos or beautiful drone footage afforded to the glass supertalls.

That’s because it was an altogether more secretive affair that emerged on the site of 220 Central Park South.

Hiten Samtani is the founder of ten31 TV and co-authored the definitive story on 220 Central Park South at The Real Deal. We worked closely with him throughout our research to help us tell this story.

"This project is a totem for everything that is decadent and depraved about New York City real estate," Samtani said.

"Billionaire battles, trench warfare, extreme engineering, class warfare ... it is a level of complexity and narrative intricacy that I've never seen in a project before."

220 Central Park South got off to a promising but quiet start. And then, seemingly out of nowhere it blew everyone out of the water.

Enter Ken Griffin.

"Ken Griffin is one of those few people in America who has both the money and the ego to try to shape cities to his will," Samtani said.

Griffin is one of the world’s richest men. The Citadel CEO and Hedge fund manager is no stranger to extreme wealth and success but he set a new standard for conspicuous consumption when he walked into 220 Central Park South and bought the most expensive residential property in US history for $238M.

Above: Ken Griffin purchased one of the penthouses in 220 Central Park South.

Pam Liebman is president and CEO of the Corcoran Group - one of the leading real estate brokerages in the country - which oversaw several sales at the property.

"Real estate people thought on one hand, wow, this is great, this just shows you that people are willing to spend this kind of money in New York City," Liebman said. "This is a building that's really making a statement."

Now, Griffin already owned several high-end properties around the world but this became the crown jewel of his portfolio. He later went on to buy two additional units within the building as well.

The purchase put 220 Central Park South in a league above even the most exclusive skyscrapers.

But hold on a minute – how did this even happen?

Well to really understand that, we need to take you back to where it all began.

The Deal

It’s early 2005 and rumours of a US real estate bubble are looming, and then there’s the New York City housing market which seems to be avoiding this trend.

During that same year, a potential deal came across the desk of a development firm called Clarett Group. It had three of the main ingredients for successful real estate: location, location and location.

The offer was to buy out an unimpressive 20-storey rental building that had a super impressive address. 220 Central Park South could offer sweeping views of the park if a newer and taller tower were put on the site.

At the time, the existing property was nearly half vacant, but still home to some 47 rent-stabilised tenants; people who were protected from sharp increases in monthly payments.

"You had everything from a professor of gerontology to a record producer, actually quite a prominent record producer," Samtani said. "He actually occupied the penthouse, and I believe he paid 1200 dollars a month in rent,"

Clarett Group saw the opportunity and ran with it. But to gain approval from the state and move forward with a whole new building, they needed money – and lots of it. With the remaining tenants on site, it wasn’t exactly a straightforward process.

"There is this particular quirk of law that if you want to demolish a rent stabilised building, you have to essentially show that you have the financing in place to build something new," Samtani said. "So it's a bit of a chicken and egg problem."

Unable to secure a loan Clarett Group instead sought out a financial partner.

Enter Vornado Realty Trust, led by Steve Roth. At that point, the real estate investment group had a market cap of over $10BN.

In August 2005, Clarett brought Vornado on as a 90% equity partner in the project and ultimately closed a deal at $137M. But the story doesn’t end there.

Before they could build what is now 220 Central Park South, work needed to be done: including tearing down the building that was there before and buying enough air rights to build taller – a task that fell to Clarett.

Yes, you heard that right. In New York City, it’s not just the buildings for sale but the air above them too.

Developers can snatch-up air rights around their properties and combine them to comply with development limits in the area and build even taller than they could before. The process can take years, but it’s what allowed 220 Central Park South – and much of Billionaires Row – to rise so high while preventing close neighbours from blocking those awesome views.

Now before you demolish a building, it’s polite to ask people to step out of it first. Here that meant buying-out tenants, and to no surprise, some of the residents of 220 were not so keen on moving out. So the firm faced an expensive battle.

"I believe in the end they were paid between $1.3 and $1.6 million each to leave," Samtani said. "That's a good chunk of money for the average New Yorker."

The project took so long and cost so much more than expected that Clarrett's upside was essentially wiped out. Vornado wrote them a check for their troubles and assumed full control.

Building a skyscraper like this is a marathon, and not everyone has the stamina to last.

Katherine Clarke, is a reporter at the Wall Street journalist and author of the book 'Billionaires' Row'.

"Steven Roth is known primarily as an office landlord, he took a really significant interest in 220 because I think it was directly the site for it was directly opposite his own office," Clarke said.

"He would look out his window and he would see that site and he would think that's the best site in New York. I need to build a condo there."

The Trojan Horse

So far, so New York. But just as this legal battle was unfolding, a Trojan horse had stealthily entered the field of play.

Enter Gary Barnett, the founder of Extell Development.

"He is a very prominent developer in New York ... and is somewhat addicted to complexity and messy decades long projects," Samtani said.

Around the time Roth was facing resident lawsuits in 2005, Barnett bought a partial stake in a 13-year lease at a basement parking garage directly below 220 Central Park South. He then went on to acquire an additional small parcel right in the middle of the Vornado development site.

Why you may ask? Well Barnett was the owner of a nearby development site between 57th and 58th street and hoped to build his own luxury property there complete with Central Park views and their accompanying price tags.

No views, means less money. So when he heard that a building at the 220 site might go up, he swung into action and set-up a bargaining chip to use against Vornado in the future.

By the time Vornado wanted to clear the site in 2011, Barnett pulled out his ace card.

Finally, in 2013, Vornado folded and agreed to pay $194M for the tiny Extell-owned parcel – and its air rights – in the middle of their development site. That’s a whopping $1,400/ft, more than twice the going rate at the time.

And in an arrangement to preserve each other’s views, Extell moved what would eventually become the mammoth Central Park Tower east, while Vornado shifted 220 slightly to the west.

Extell’s supertall skyscraper also introduced a cantilever that extended 8.5 metres out above The Art Students League of New York Building for the small payout of $32M, thus ensuring more units could keep their views of the park.

At last, Vornado could move forward with its plans.

Or, so they thought. Construction in New York City is anything but cheap, even for a titan of a developer like Vornado. So the firm reached out to someone with even deeper pockets.

To build 220 Central Park South, Roth borrowed a cool $600M from the Bank of China in 2014, followed by an extra $350M the year after.

By this point, 220 Central Park South had been years in the making. It had secured developers, funding and cleared a plot of land in busy midtown Manhattan.

Above: 220 Central Park South begins to rise. Courtesy of Tectonic Photo.

The Build

Now it was time for the fun part, and architect Robert AM Stern, was hired to handle the design.

220 Central Park South is a truly remarkable feat of construction. Its rectangular form rises 290 metres into the sky but measures just 16 metres across – that’s a width-to-height ratio of 1:18.

But to go up, construction teams first had to dig down. Through controlled blasting and painstaking rock hammering they excavated 15 metres into the bedrock and installed three 2.5-metre thick concrete slabs and 142 rock anchors. Working so close to existing buildings, they constantly monitored them to ensure their structures weren’t being affected.

With foundations complete, construction crews moved above ground and began constructing the skyscraper’s most critical structural element – its spine: the concrete core.

Take a look at your standard skyscraper floor plan and you’ll always see the core in the middle. It means your structural beams that hold each of the floors up can run out to the perimeter columns and don’t have far to go.

It’s also where you’ll always see the elevator shafts, services, stairs and bathrooms – it makes for a good vertical access route up through your structure and means the people in your tower all get natural light and a nice view out.

But there was only one view that mattered at 220 Central Park South.

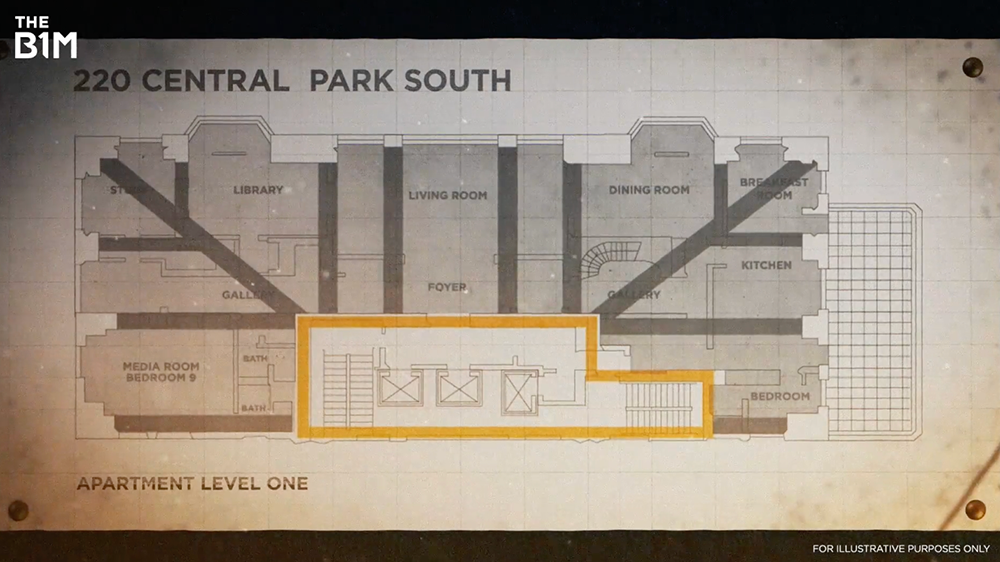

The Real Deal got ahold of the floor plans so we've recreated them to show exactly how wealth is shaping engineering decisions.

Above: The B1M's recreation of the floor plan at 220 Central Park South.

To maximise saleable area, the core was pushed to the southern perimeter. Any interior columns were eliminated to create an open flexible floor plan in the apartments and that – now much larger – gap between the core and the northern perimeter was bridged with a 28-cm thick concrete slab.

Towers like this are subject to extreme wind loads and a phenomenon called vortex shedding, where differing air current speeds can pull at the structure causing it to sway.

To counteract this, 220 includes a huge 1,100-tonne swinging weight in a space near its summit known as a tuned mass damper.

With a total of 118 apartments, the 220 project combines a shorter 18-storey structure known as ‘The Villa’ with a much taller 70-storey tower behind it.

But precast or handset limestone wouldn’t work for a building this tall – so a limestone curtain wall system was developed instead.

Unlike glass, this material is opaque, and that allowed engineers to hide more spandrel beams behind it around the perimeter of the tower. When combined with the sheer walls between the smaller apartments on the lower levels, this approach helped further improve the building’s overall strength and stiffness.

Finally an unusual “megaframe” concept was adopted. This grouped the main perimeter columns on the northern facade into four. The columns were much larger, but helped maximise those Central Park views – another illustration of how almost every inch of this building has been shaped by the market its targeting.

The tower was expensive to say the least. We couldn’t get our hands on official figures but Steve Roth claimed Vornado was spending around $5,000 per square foot on construction.

That eye-watering sum would be way above the circa $3,000 that other Billionaires Row towers spent and quite clearly in a whole different galaxy to your average walk-up apartment.

It’s a budget that gets you all kinds of things: from oak-flooring and marble cladding to saltwater pools. In total, the building cost around $1.5BN.

Roth went big, confident that he could up the sale price – and it worked. The building went on to drive more than $3BN in sales for Vornado, according to Corcoran Group. Roth had built the most profitable condo in the world.

But to get returns like that, you need to think outside the box.

Backend Deals

As you may have realised, there are only so many people in the world who can afford an apartment like this. Even on Billionaires’ Row, a $238M sale is out of the ordinary.

"These are helicopter people, their feet don't touch the ground," Samtani said.

"They go from private school to charity gala to penthouse. They're not interacting with the average city dweller, so they're living in this different world, and often developers are thinking about them and building for them."

"We just had enough people coming to us, and then it just took on a life of its own," Liebman said. "We did it very quietly. People signed NDAs, we invited code brokers in."

There are 8 billion people on our planet, but a little over 2,600 of them are billionaires – so right from the start, there’s an incredibly small demographic of buyers who can realistically afford these units.

Now, not everyone in the building is a billionaire, but it’s a good place to start.

Cut to May 2015.

220 Central Park South had just launched sales and Roth hopped on an earnings call to reveal the big news.

"In just 6 short weeks, without any advertising, marketing or outreach whatsoever, we have already – we already have commitments for over $1.1 billion representing about 1/3 of the building. So 1/3 of the building is now sold," Roth said.

Now, hang on a minute. No advertising. No marketing. Not even a website. And yet over $1BN in sales in just over a month. How did they do this? After all, your typical luxury condo market is, well, a bit more flashy when it comes to getting the word out.

Steve Roth on the other hand went in a different direction.

"Steven Roth treated that building less like a condo and more like his own personal country club," Clarke said. "So he took a really significant interest in who was buying there, who would be allowed to come and see the units."

"It created this velvet rope effect where if you weren't allowed to be in there, you wanted to be in there even more. And that really sent the value skyrocketing."

"He knew what he was doing," Liebman said. "He treated that building as though he was going to live in every apartment."

"Most developers, when they're planning it, they start to value engineer it. He did the opposite. He would add things to make it better. So he created this vision of building me, a billionaire would live in. So there was right off the bat this big feeling of comfort from all these other buyers that if Steve's in charge, this is going to be different."

Wealthy domestic purchasers were dropping tens of millions on units. The CEO of Paramount Group paid $33.5M. The founder of Arel Capital got a place for $26.2M. Even Sting became an official Englishman in New York.

After years of plotting, planning and persistence 220 Central Park South had become the crème de la crème of Billionaires’ Row.

Above: 220 Central Park South became the crown jewel of Billionaires' Row. Image courtesy of The Dronalist

The Backlash

Like so many things in life, reaching the top gets you noticed – and just as the team behind the supertall celebrated their success, the city of New York began to pay attention.

The record-breaking apartment in the sky stirred up debate over the shocking wealth disparity being experienced back down on the ground.

Some politicians used the news to resurface the proposed pied-a-terre tax on owners with second homes valued over $5M and generate millions of dollars for the city. But they’re still struggling to keep up with Billionaires’ Row.

"Legislators are deeply steeped in the intricacies of New York City real estate," New York State Senator Brad Hoylman-Sigal said.

"Billionaires' Row is the essence of trophy real estate. We don't know the level of taxes they pay. So if they don't live here, they're not contributing to the same degree as the rest of us toward central City services."

The pied-a-terre tax would be a small surcharge on these properties – a move some felt to be entirely reasonable since so many were just investment vehicles that often sat empty. The tax had actually been pushed before, back in 2014, but it was always a longshot.

"Obviously, I think that's ridiculous," Liebman said.

"These are people who spend a lot of money and put a ton of money into our city and fund so much of what makes New York what it is. You would never want to antagonize or alienate these people. And we already have significant taxes when people buy these kind of apartments. I mean, it was big. Very, very big. Thank you, Steve. The city should be thanking him."

Ultimately, the pied-a-terre tax was lobbied against and lawmakers dropped it in favour of a newly enacted mansion tax – an additional charge on properties valued over $1M.

"Wealthy people in our city is a good thing if it contributes to the lifeblood of our economy, I'm not certain, though, that that always is the case," Senator Hoylman-Sigal said.

"New York should always be the home for the best, including real estate. We just need to ensure that there's transparency and accountability every step of the way."

This building speaks of so much: incredible engineering, a rising wealth gap, the relentless ambition to maintain and grow that wealth among the world’s richest people, the complicated relationship between government and real estate – and above all else, the power of money in a city that’s constantly reinventing itself.

Like a diamond formed under immense pressure, in the perfect conditions and at exactly the right time, 220 Central Park South has risen as a monument to all of it – the good, the bad and the ugly.

The city's buildings have always adapted to whatever history is thrown at them. They've always responded and evolved to help New York keep pace.

We saw it with the construction of the first skyscrapers here in the early part of the 20th century, with the construction of the World Trade Center in the 1970s and then the rebuilding of the World Trade Center after 911. We saw it with the way developers built skyscrapers over a light rail yard, and most recently we're seeing in the form of Billionaires' Row.

But even among all that, the story of 220 Central Park South sets an extreme new bar, even among the engineering, or put it as a row. It stands out for the most extreme of reasons.

"This exact combination of greed, wealth, design, litigation, it doesn't exist anywhere else in the world, not even close," Samtani said. "New York City is the only place this could happen."

"I don't think we're going to see another phenomenon like Billionaires' Row for quite some time," Clarke said.

"I think we saw that narrative play out and the people who got in a little bit too late lost a lot of money, had a lot of trouble, and we're not seeing the same hunger to build that ultra ultra luxury real estate anymore. At least at that level, at that scale."

History is littered with examples of cities that became so great, so renowned, but then ultimately pushed too far. Is New York headed the same way?

This story was created in collaboration with The Real Deal building upon reporting from The inside story of 220 Central Park South, the world’s most profitable condo.

Check out AMD's new line of Threadripper 7000 WX-Series CPUs here.

Special thanks to The Real Deal, Katherine Clarke, Hiten Samtani, E.B. Solomont, Jonathan Miller, Brad Hoylman-Sigal, Pam Liebman, and The Dronalist.

Additional footage and images courtesy of The Dronalist, The Real Deal, NY1, Warner Brothers, Library of Congress, Columbia Library, Erik Conover, CBS News, DAVE-O, Wil540 Art, Jim Hinderson, Beyond my Ken, David Shankbone, Paul Elledge/Citadel Enterprise Americas LLC, U.S. Marine Corps, Apple, Historic Districts Council, Buena Vista, CNBC, WGN News, Bloomberg TV, Paul Elledge, MRWOOT, Vator, Tectonic Photo, Marshall Gerometta, HSI Productions, Tech5, 20th Century Fox, Logowik, zubazpants, BBC News, AMC, JDS Development, Extell Development, CBS New York, Fox 5 New York, Svenska Biografteatern, Tdaileader, Franck Nataf, Western Electric, Google Maps, GoogleEarth Studio, timpmalonenyc, Mvvvc, theseandevine, tdaileader, WCPO7 Franck Nataf, Paramount Pictures, Oscars, CBS, ABC News, AMC, WCOP9, NBC and Fox.

We welcome you sharing our content to inspire others, but please be nice and play by our rules.